Who is the no. 1 richest country in the world

In a world grappling with economic disparities and aspirations of prosperity, the question of which nation reigns supreme in terms of wealth inevitably arises. This article embarks on a comprehensive exploration to identify the country that holds the coveted title of being the wealthiest in the world. Through a thorough analysis of economic indicators, geopolitical factors, and historical trends, we unravel the intricacies of this global ranking.

Determining the Richest Country in the World: A Complex Question

Defining the "richest" country is surprisingly complex. There's no single, universally accepted metric. Different measurements, such as Gross Domestic Product (GDP), GDP per capita, wealth per adult, and total national wealth, all yield different results. Each metric provides a unique perspective on a nation's economic strength and the distribution of that wealth among its citizens. Therefore, declaring one country definitively as "number one" requires careful consideration of the chosen indicator and its limitations.

1. GDP (Gross Domestic Product) as a Measure of Wealth

GDP is the total value of goods and services produced within a country's borders in a specific period. While a high GDP indicates a large economy, it doesn't account for population size. A country with a massive GDP might have a lower GDP per capita than a smaller nation with a more efficiently distributed economy. The United States typically ranks highest in terms of nominal GDP, signifying its enormous economic output. However, this doesn't necessarily translate to the highest wealth per person.

2. GDP per Capita: Wealth per Person

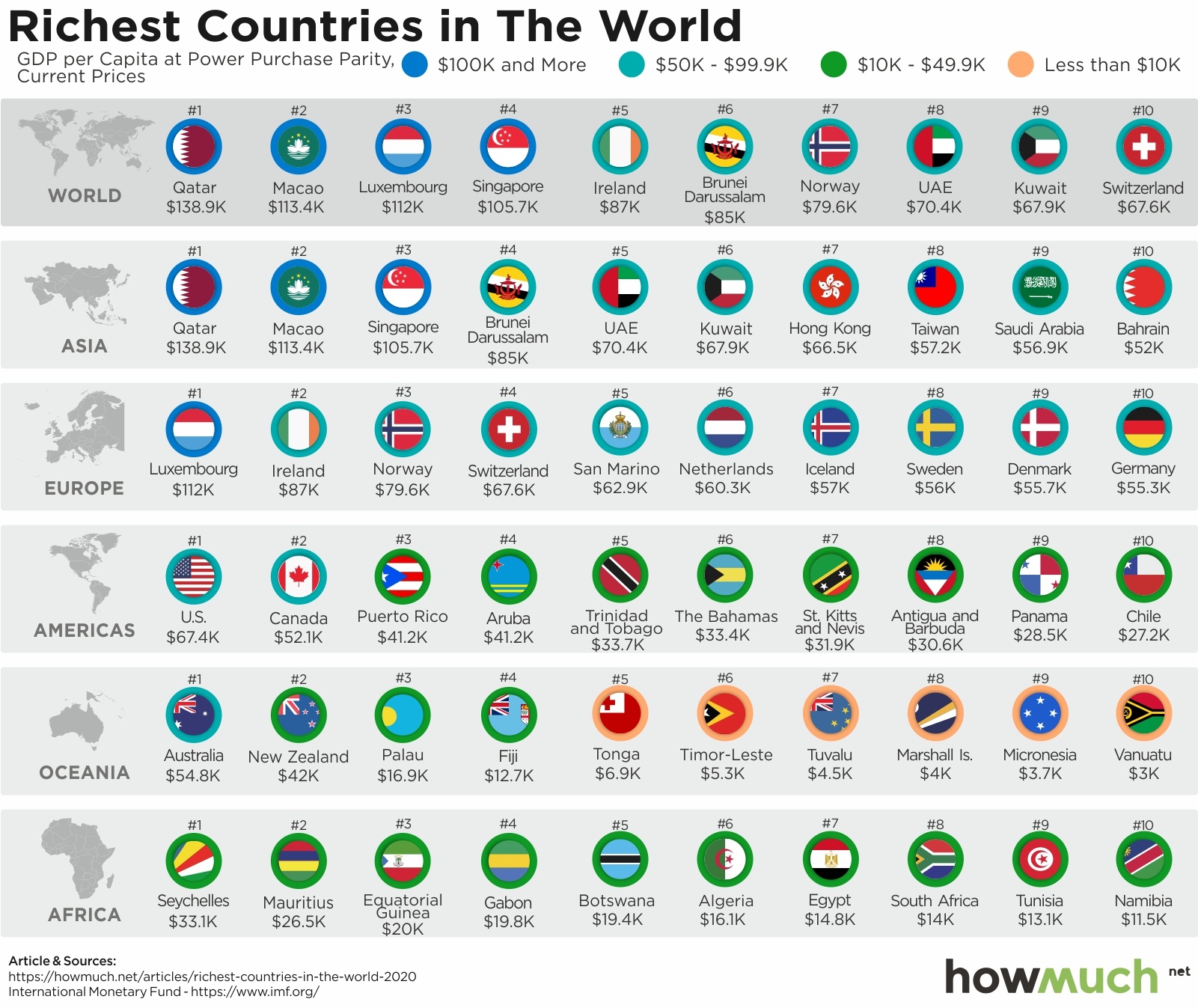

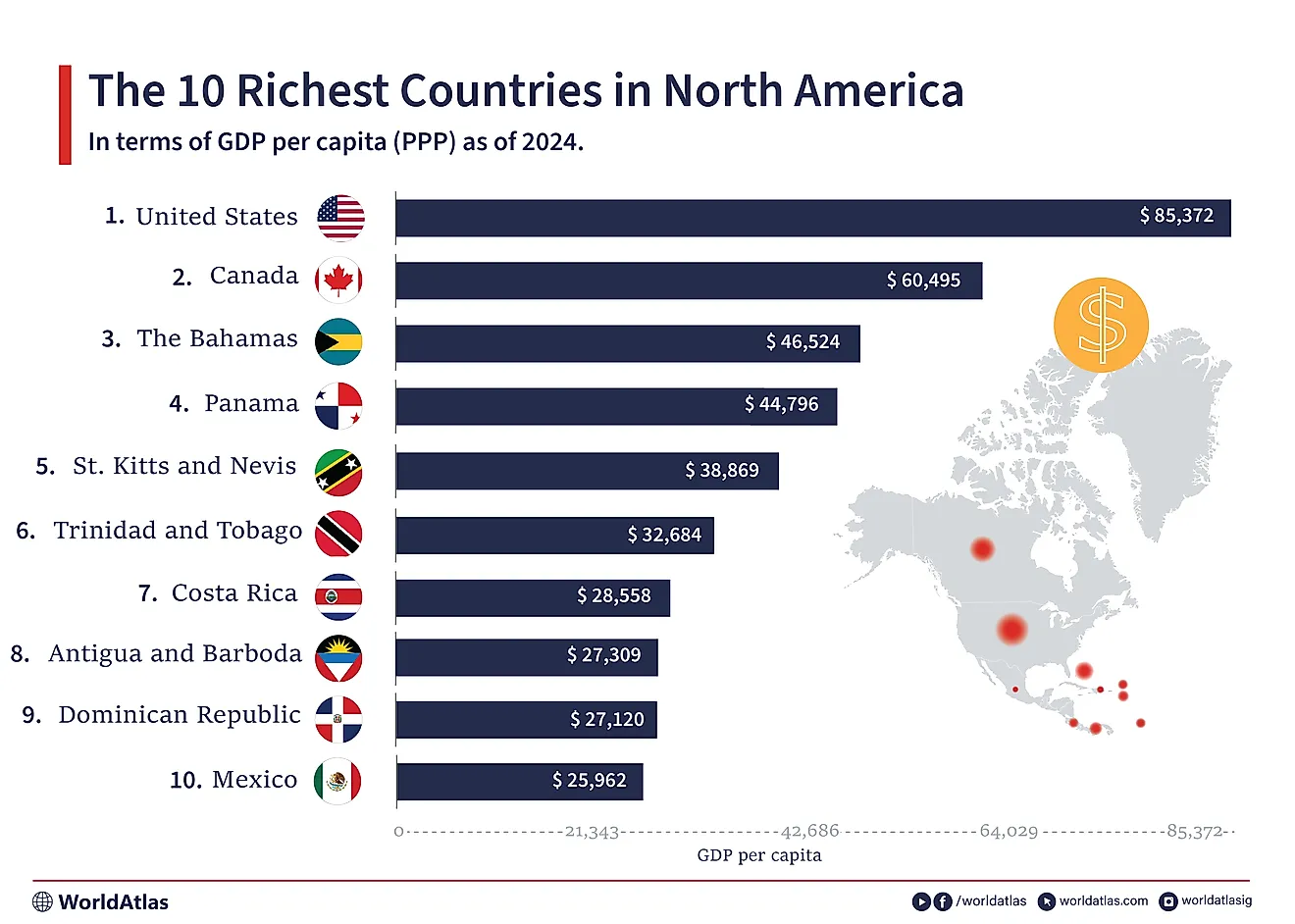

GDP per capita is calculated by dividing a country's GDP by its population. This provides a better understanding of the average wealth per individual. Countries like Luxembourg, Qatar, and Singapore often top the list in terms of GDP per capita, reflecting a higher standard of living for their citizens compared to nations with large populations but lower overall GDP. This metric is crucial for comparing living standards but doesn't fully reflect wealth inequality within a nation.

3. Total National Wealth: A Broader Perspective

Total national wealth encompasses a country's total assets, including physical assets (land, buildings, infrastructure), financial assets (stocks, bonds), and natural resources. This metric offers a comprehensive view of a nation's overall riches. While data on total national wealth is less readily available than GDP figures, it provides a different picture, suggesting that countries with vast natural resources or substantial accumulated assets might rank differently than those solely measured by GDP. This metric is more holistic than GDP but is also challenging to accurately measure and compare across countries.

4. Wealth Inequality: Distribution Matters

Even with high GDP or GDP per capita, wealth inequality significantly impacts the overall well-being of a nation's citizens. A country might have a high average wealth, but a large portion of its wealth may be concentrated in the hands of a small elite, leaving a considerable portion of the population impoverished. Therefore, considering the distribution of wealth is crucial when assessing a nation's overall prosperity. Reliable data on wealth distribution remains a challenge for accurate international comparisons.

5. Challenges in Comparing National Wealth

International comparisons of wealth are fraught with difficulties. Different countries employ varying accounting methods, data collection techniques, and definitions of wealth. Informal economies, which are often substantial in developing countries, are difficult to quantify and integrate into official statistics. These inconsistencies make direct comparisons challenging and contribute to the lack of a definitive "richest" country title. Transparency and data standardization are vital for improving cross-national comparisons of national wealth.

| Metric | Top-Ranking Countries (Examples) | Limitations |

|---|---|---|

| GDP | United States, China, Japan | Doesn't account for population size; ignores wealth distribution. |

| GDP per capita | Luxembourg, Qatar, Singapore | Can mask wealth inequality; doesn't include non-monetary aspects of well-being. |

| Total National Wealth | Data less readily available, but often includes countries with significant natural resources or accumulated assets. | Difficult to accurately measure and compare across countries. |

What is the top 10 richest country?

Determining the "richest" country is complex and depends on the metric used. There's no single universally agreed-upon definition. Different organizations use various measures like nominal GDP, GDP per capita (PPP), and total wealth. Rankings can also fluctuate based on economic changes and data revisions. Therefore, the following list represents a common interpretation based on several prominent metrics, focusing primarily on nominal GDP. It's crucial to remember that these rankings are snapshots in time and are subject to change.

Nominal GDP Rankings: Understanding the Limitations

Ranking countries by nominal GDP provides a picture of the total economic output at current market prices. However, it doesn't account for population size, purchasing power parity (PPP), or income distribution. A high nominal GDP doesn't necessarily mean a high standard of living for all citizens. This ranking focuses on the sheer size of the economy, not necessarily the wealth of individual citizens.

- Ignores Purchasing Power Parity (PPP): PPP adjusts for differences in the cost of goods and services between countries, giving a more accurate picture of relative living standards.

- Doesn't reflect income inequality: A country with a high nominal GDP might have extreme wealth inequality, meaning a small percentage of the population controls most of the wealth.

- Subject to currency fluctuations: Exchange rates can significantly impact nominal GDP rankings, causing shifts over time.

GDP per Capita (PPP): A More Nuanced Metric

GDP per capita (PPP) adjusts for purchasing power parity, offering a better understanding of the average citizen's economic well-being. This metric divides the total GDP by the population, giving a clearer picture of wealth distribution across a country's citizens. While not a perfect measure, it offers a more balanced perspective than nominal GDP alone. Higher GDP per capita generally suggests a higher standard of living, but it doesn't fully account for factors like income inequality or access to essential services.

- Better reflection of living standards: PPP adjusts for the cost of goods and services, providing a more accurate comparison of living standards across countries.

- Still doesn't capture income inequality: A high GDP per capita doesn't automatically mean that wealth is evenly distributed.

- Data challenges: Accurately measuring PPP across diverse economies presents significant methodological challenges.

Total Wealth: Beyond Annual Output

Total wealth considers a broader range of assets beyond annual economic output, encompassing things like real estate, infrastructure, and natural resources. This provides a more comprehensive picture of a nation's overall economic strength. This metric offers a long-term perspective on a country's economic health, as it goes beyond the annual fluctuations in GDP. However, it can be challenging to accurately assess a nation's total wealth, as some assets are difficult to quantify precisely.

- Includes non-income assets: Considers assets like real estate, infrastructure, and natural resources, offering a more comprehensive picture of wealth.

- Provides a long-term view: Offers a more stable measure of economic strength than GDP, which is susceptible to annual fluctuations.

- Measurement challenges: Accurately valuing and measuring different asset types can be difficult and prone to error.

Factors Influencing Economic Strength

Several factors contribute to a country's economic standing. These include, but aren't limited to, a nation's natural resources, technological innovation, workforce skills, political stability, and sound economic policies. Strong institutions, including an efficient legal system and low corruption, also play a vital role. Furthermore, access to global markets and investment opportunities significantly impacts economic growth.

- Natural Resources: Abundant natural resources can drive economic growth.

- Technological Innovation: Countries that foster innovation often have stronger economies.

- Human Capital: A skilled and educated workforce is essential for economic success.

The Dynamic Nature of Economic Rankings

It is important to remember that economic rankings are not static. They continuously evolve due to various factors including global events, policy changes, technological advancements, and shifts in global markets. These rankings should be interpreted as snapshots in time, rather than definitive measures of long-term economic strength. Regular monitoring and analysis are crucial to understanding the ongoing evolution of global economies.

- Global events: Economic crises and wars can significantly impact rankings.

- Policy changes: Government policies can promote or hinder economic growth.

- Technological advancements: Innovation drives economic shifts and changes competitiveness.

Is the USA a rich country?

Whether the USA is a "rich" country is a complex question with no simple yes or no answer. It depends heavily on how you define "rich." While the US boasts the world's largest economy by nominal GDP, a significant portion of its wealth is concentrated in the hands of a relatively small percentage of the population. This leads to vast disparities in wealth distribution, creating a situation where some Americans enjoy extraordinary affluence while others struggle with poverty and economic insecurity. Therefore, while the nation's overall economic output is undeniably high, assessing its "richness" requires considering factors beyond mere aggregate wealth.

GDP and Economic Output

The US possesses the world's largest nominal Gross Domestic Product (GDP), indicating a massive overall production of goods and services. This high GDP contributes to a strong global economic influence. However, this figure alone doesn't capture the nuances of wealth distribution. High GDP doesn't automatically translate to widespread prosperity.

- High nominal GDP: The US consistently ranks highest in nominal GDP, indicating immense economic output.

- Economic power: This high GDP translates to significant global economic influence and power.

- Uneven distribution: Despite high overall output, wealth is not evenly distributed, impacting the overall quality of life for a segment of the population.

Wealth Inequality

The US grapples with significant wealth inequality, a major factor complicating the question of national "richness." A small percentage of the population holds a disproportionate share of the nation's wealth, leaving a substantial portion of the population with limited resources. This disparity manifests in various socioeconomic indicators, impacting access to healthcare, education, and housing.

- High Gini coefficient: The US has a relatively high Gini coefficient, indicating high levels of income inequality.

- Wealth concentration: A small percentage of the population holds a significant portion of the national wealth.

- Limited social mobility: The high inequality limits social mobility, making it difficult for individuals to improve their socioeconomic standing.

Infrastructure and Public Services

The quality of infrastructure and public services, like healthcare and education, is a key indicator of a nation's overall well-being. While the US invests significantly in certain areas of infrastructure, inconsistencies exist across regions and sectors. Access to quality healthcare and education is also unevenly distributed, often tied to socioeconomic status.

- Uneven infrastructure development: Infrastructure quality varies significantly across different regions of the US.

- Healthcare access disparities: Access to quality and affordable healthcare remains a significant challenge for many Americans.

- Educational inequalities: Educational opportunities are not equally available to all, creating disparities in future economic prospects.

Poverty and Economic Insecurity

Despite its high GDP, the US has a significant poverty rate and a considerable population experiencing economic insecurity. Millions of Americans struggle to meet basic needs such as food, housing, and healthcare. This suggests a disconnect between the nation's overall economic strength and the economic well-being of a significant portion of its citizens.

- High poverty rate: The US has a relatively high poverty rate compared to other developed nations.

- Economic insecurity: Many Americans face significant economic insecurity, lacking financial stability and safety nets.

- Food insecurity: A substantial portion of the population experiences food insecurity, lacking consistent access to nutritious food.

International Comparisons

Comparing the US to other developed nations reveals a mixed picture. While the US boasts a high GDP, its performance on social indicators, like life expectancy, infant mortality, and poverty rates, sometimes lags behind other wealthy countries. This suggests that while the nation's economic output is high, its translation into improved social outcomes for all citizens is not as effective as in some peer nations.

- Lower social indicators: Some social indicators, such as life expectancy, are lower than in comparable developed nations.

- Higher inequality compared to peers: The level of wealth inequality in the US exceeds that of many other developed countries.

- Variations in social programs: The US has a different approach to social safety nets compared to other developed nations, impacting social outcomes.

What is the 3 richest country in the world?

What is the 3rd Richest Country in the World?

Determining the "richest" country depends on the metric used. While nominal GDP often takes center stage, other measures like GDP per capita offer a different perspective on wealth distribution. Based on nominal GDP, the third richest country in the world is typically considered to be Germany. However, rankings can fluctuate slightly depending on the source and the year's economic performance.

Factors Contributing to Germany's Wealth

Germany's robust economy is a product of several key factors. Its highly skilled workforce, strong manufacturing sector, and export-oriented economy contribute significantly to its overall wealth. The country is a global leader in various industries, including automobiles, machinery, and chemicals. Furthermore, a stable political and economic environment fosters investment and growth.

- Strong Export-Oriented Economy: Germany is a major exporter of manufactured goods, generating significant revenue from international trade.

- Skilled Workforce: A highly educated and skilled workforce contributes to high productivity and innovation.

- Advanced Manufacturing Sector: Germany's manufacturing sector is renowned for its quality and technological advancement.

Germany's GDP and Economic Performance

Germany consistently boasts a high nominal GDP, placing it among the world's economic powerhouses. Its economic performance is closely monitored globally, influencing international markets and financial trends. The country’s stable political landscape and robust regulatory framework also contribute to a predictable and attractive investment climate. Fluctuations in the global economy can, however, impact Germany's economic growth.

- High Nominal GDP: Germany's consistently high nominal GDP reflects its strong economic performance.

- Economic Stability: A relatively stable political and economic environment attracts foreign investment.

- Global Influence: Germany’s economic performance significantly impacts global economic trends.

Comparison with Other High-GDP Countries

While Germany consistently ranks highly, its position relative to other countries like the United States and China can shift based on yearly economic data. Comparisons are complex, as different metrics (nominal GDP, GDP per capita, purchasing power parity) yield varying results. Analyzing these differences offers valuable insights into the nature of wealth and its distribution.

- Nominal GDP vs. GDP per Capita: Nominal GDP reflects overall economic size, while GDP per capita provides a measure of wealth per person.

- Purchasing Power Parity (PPP): PPP adjusts for differences in the cost of living across countries, providing a more accurate comparison of living standards.

- Economic Diversification: The diversity of an economy influences its resilience to global shocks.

Challenges Facing the German Economy

Despite its economic strength, Germany faces various challenges. These include an aging population, which could impact the workforce, and the need for ongoing innovation to maintain its competitive edge in global markets. Adapting to technological advancements and managing potential disruptions from climate change are also crucial.

- Aging Population: A shrinking workforce presents a challenge for maintaining economic growth.

- Technological Innovation: Constant innovation is necessary to stay competitive in a rapidly evolving global landscape.

- Climate Change Adaptation: Addressing the economic impacts of climate change is crucial for long-term sustainability.

Data Sources and Methodology

Rankings of the richest countries rely on data from various international organizations, including the International Monetary Fund (IMF) and the World Bank. These organizations employ different methodologies and data collection techniques. Therefore, minor variations in rankings across different sources are expected, highlighting the importance of considering the specific methodology used when interpreting such data.

- IMF Data: The International Monetary Fund provides extensive data on global economies.

- World Bank Data: The World Bank offers valuable insights into global economic development.

- Methodology Differences: Variations in methodology can lead to slight differences in rankings.

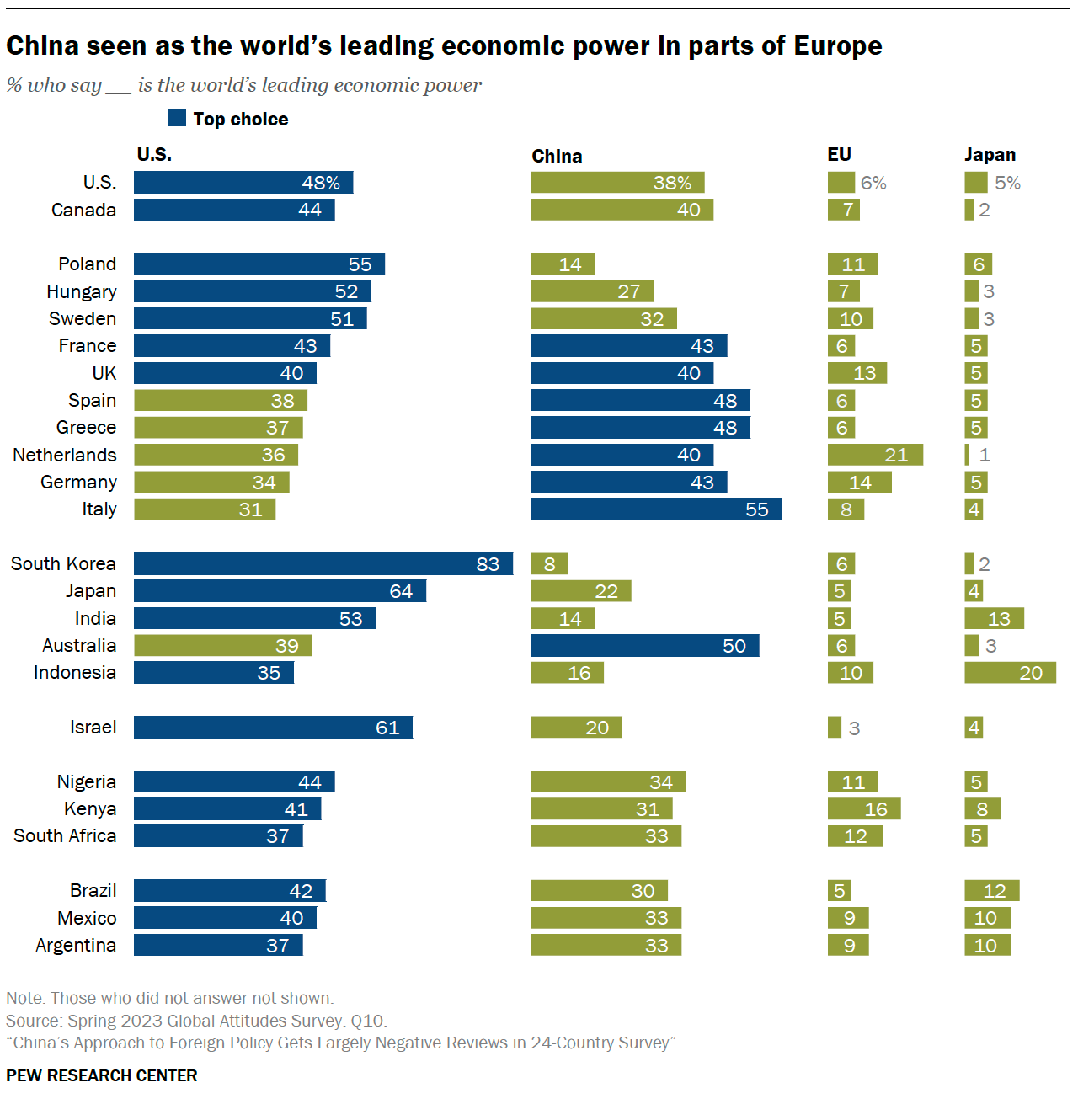

Which country has the best economy?

There is no single answer to the question of which country has the "best" economy. The definition of "best" is subjective and depends on the metrics used for evaluation. Different countries excel in different areas, and economic performance is constantly fluctuating. Factors such as GDP, GDP per capita, economic growth rate, income inequality, unemployment rate, and debt levels all contribute to a country's overall economic health. A country might have a high GDP but also significant income inequality, or a high growth rate but unsustainable debt. Therefore, any ranking of "best" economies is inherently complex and dependent on the chosen criteria. No single country consistently ranks highest across all relevant indicators.

Factors Affecting Economic Rankings

Several key factors influence a country's economic standing. GDP (Gross Domestic Product) is a widely used measure of a nation's overall economic output, but it doesn't account for population size. GDP per capita provides a better measure of average income, but it might mask income inequality. Economic growth rate reflects the pace of economic expansion, but sustained growth is vital, not just a short-term spike. Inflation, a persistent increase in prices, can erode purchasing power and hinder economic stability. Finally, Government debt can place a significant burden on future economic prospects.

- GDP: The total value of goods and services produced within a country's borders.

- GDP per capita: GDP divided by the population, giving an average income per person.

- Economic growth rate: The percentage change in a country's GDP over time.

The Role of Global Economic Conditions

The global economy significantly impacts individual national economies. International trade, foreign investment, and global financial markets all play a crucial role. A global recession can severely impact even the strongest economies, while global growth can boost performance. Geopolitical events and global supply chain disruptions also affect economic stability. Therefore, any assessment of a country's economic strength must consider the broader global context.

- Trade Wars: Disputes between countries can disrupt international trade flows.

- Global Recessions: Worldwide economic slowdowns affect most countries.

- Supply Chain Issues: Disruptions can impact production and inflation.

Measuring Economic Strength: Beyond GDP

While GDP is a widely used metric, it doesn't tell the whole story. Human Development Index (HDI) considers factors like life expectancy, education levels, and standard of living, offering a more holistic view. Gini coefficient measures income inequality within a country. Unemployment rate indicates the percentage of the workforce without jobs. A comprehensive evaluation requires considering these diverse indicators beyond simply GDP or GDP per capita.

- HDI: Combines life expectancy, education, and income per capita.

- Gini Coefficient: Measures income inequality within a country.

- Unemployment Rate: Percentage of the workforce actively seeking employment but without jobs.

The Impact of Political and Social Factors

Political stability, sound governance, and effective institutions are essential for strong economic performance. Corruption can hinder economic development, while strong rule of law promotes investment and growth. Social factors, such as education levels, healthcare access, and social safety nets, also have significant impacts. A healthy and well-educated workforce is a crucial asset for a thriving economy.

- Political Stability: Stable governments attract investment and facilitate economic growth.

- Rule of Law: Strong legal frameworks protect property rights and encourage investment.

- Social Safety Nets: Programs like unemployment insurance and healthcare support economic stability.

Long-Term Economic Sustainability

Focusing solely on short-term growth can be detrimental in the long run. Environmental sustainability and resource management are increasingly important considerations. Countries that prioritize sustainable practices and responsible resource use are likely to experience more stable and long-term economic success. Ignoring environmental concerns can lead to future economic vulnerabilities.

- Climate Change: The effects of climate change pose significant economic risks.

- Resource Depletion: Overuse of natural resources can lead to future shortages.

- Sustainable Development: Balancing economic growth with environmental protection.

What criteria are used to determine the richest country in the world?

Determining the "richest" country is not a straightforward process, as there's no single, universally accepted metric. Different organizations and studies employ various criteria, leading to varying results. Gross Domestic Product (GDP) is a frequently used indicator, representing the total value of goods and services produced within a country's borders in a specific period. However, simply looking at nominal GDP can be misleading, as it doesn't account for differences in population size or purchasing power. Therefore, GDP per capita (GDP divided by population) offers a more nuanced picture of average wealth. Furthermore, purchasing power parity (PPP) is another important factor. PPP adjusts GDP figures to reflect the relative cost of goods and services in different countries. A country might have a high nominal GDP but a lower PPP-adjusted GDP, meaning its citizens' purchasing power is comparatively lower despite the high overall economic output. Other factors sometimes considered include wealth distribution (how evenly wealth is spread among the population), national debt, natural resources, and human development indicators such as life expectancy, education levels, and healthcare access. The "richest" country, therefore, depends heavily on the specific metric employed and the weighting given to different factors.

Which country is consistently ranked as the richest by various metrics?

While the precise ranking fluctuates depending on the year and the specific metric used, the United States consistently ranks among the wealthiest nations globally, frequently topping lists based on nominal GDP. However, its position relative to other countries, like China, shifts depending on whether nominal GDP, GDP per capita, or PPP-adjusted GDP is used. China, for example, boasts a massive nominal GDP but a lower GDP per capita due to its significantly larger population. This highlights the complexities in defining "richest." Some years, Luxembourg may top lists based on GDP per capita due to its small population and high national income. Ultimately, there isn't one single country consistently deemed the absolute "richest" across all measures, emphasizing the need to consider multiple metrics to get a comprehensive understanding of a nation's economic strength and the wealth of its citizens. The ranking often depends on the specific economic data and methodology used by different research institutions.

What are the limitations of using GDP as the sole measure of a country's wealth?

Using GDP as the sole determinant of a nation's wealth has significant limitations. Firstly, GDP doesn't account for income inequality. A country with a high GDP might still have a substantial portion of its population living in poverty, while a smaller country with a lower GDP might exhibit a more equitable wealth distribution. Secondly, GDP doesn't reflect the informal economy, encompassing activities like subsistence farming or unregulated businesses that are not officially tracked. This means that a significant portion of economic activity in many countries is excluded from GDP calculations, potentially underrepresenting the actual economic output. Thirdly, GDP doesn't consider environmental factors. A country might achieve high GDP growth through environmentally damaging practices, resulting in long-term environmental costs not reflected in GDP figures. Finally, GDP doesn't capture social well-being. A country with a high GDP might have low levels of happiness, health, or education, underscoring the limitations of using GDP as a comprehensive measure of national prosperity. A more holistic view necessitates considering factors beyond GDP, including social indicators, environmental sustainability, and income equality.

How often are these rankings updated, and where can I find reliable data?

Rankings of the world's richest countries are typically updated annually, often coinciding with the release of new economic data from organizations like the International Monetary Fund (IMF), the World Bank, and national statistical agencies. The frequency of updates can vary depending on the specific metric and the data availability. For reliable data, you should consult reputable sources such as the IMF's World Economic Outlook database, the World Bank's World Development Indicators, and publications from organizations like the Organisation for Economic Co-operation and Development (OECD). Be aware that different sources might use slightly different methodologies, leading to minor variations in rankings. It's recommended to consult multiple sources to get a more comprehensive and balanced understanding of the global economic landscape and to compare methodologies used to arrive at different conclusions regarding the "richest" country.

Deja una respuesta