Who has the worst economy in South America

Amidst the diverse economic landscapes of South America, there exists a spectrum of disparities. While some nations boast thriving markets and progressive growth, others grapple with economic challenges that weigh heavily on their citizens. It begs the question: who bears the unenviable distinction of having the worst economy in South America? As we delve into the complexities of economic indicators and underlying factors, we embark on an exploration to uncover which nation endures the most severe economic trials.

Who Has the Worst Economy in South America? A Complex Question

Determining which South American country has the "worst" economy is incredibly complex and depends heavily on the metrics used. There's no single answer, as different indicators paint different pictures. Instead of a simple ranking, it's more accurate to discuss countries facing significant economic challenges. Factors like GDP per capita, inflation rates, poverty levels, unemployment, and external debt all contribute to a nation's overall economic health. A country might have a low GDP per capita but strong growth, while another might have a higher GDP but high inequality and instability. This makes definitive statements difficult and requires a nuanced understanding of each nation's context.

Venezuela's Hyperinflation and Economic Collapse

Venezuela consistently ranks among the countries with the worst economic performance in South America, if not the world. Years of mismanagement, corruption, and a reliance on oil have led to hyperinflation, widespread poverty, and a collapse of essential services. The Bolivar, the Venezuelan currency, has experienced catastrophic devaluation, rendering savings worthless and making basic goods unaffordable for much of the population. The country faces severe shortages of food and medicine, forcing millions to flee the country in search of better opportunities. While recent attempts at economic reforms have been made, the long-term outlook remains uncertain and incredibly bleak.

Argentina's Persistent Economic Instability

Argentina has a long history of economic volatility. Recurring cycles of inflation, devaluation, and debt crises have plagued the country for decades. While it has periods of growth, these are often followed by sharp downturns. High levels of public debt, a complex regulatory environment, and political instability all contribute to Argentina's economic struggles. The Argentine Peso has consistently lost value against major currencies, impacting purchasing power and fueling inflation. Although Argentina possesses considerable natural resources, its economic performance is consistently hampered by internal factors.

Nicaragua's Authoritarianism and Economic Stagnation

Nicaragua's economy has suffered significantly due to a combination of political repression and decreased investor confidence. The government's authoritarian actions have driven away foreign investment and hindered economic growth. Political instability and human rights concerns have created an unfavorable environment for businesses, leading to reduced economic activity and limited opportunities. While the country boasts some agricultural potential, the overall economic outlook remains constrained by the political climate.

Haiti's Persistent Poverty and Vulnerability

Haiti consistently ranks among the poorest countries in the Western Hemisphere. It faces multiple challenges, including natural disasters, political instability, and widespread poverty. A lack of infrastructure, limited access to education and healthcare, and weak governance all contribute to Haiti's ongoing economic struggles. The country is highly vulnerable to external shocks, such as hurricanes, which can further exacerbate its already precarious economic situation. While international aid is provided, substantial progress towards sustainable economic development remains elusive.

Bolivia's Dependence on Commodity Prices

Bolivia's economy, while showing some improvement in recent years, remains heavily reliant on the export of raw materials, particularly natural gas and minerals. This makes it highly susceptible to fluctuations in global commodity prices. While government policies have aimed to diversify the economy, dependence on commodity exports creates vulnerability and limits long-term growth potential. Economic inequality also remains a significant challenge, with a large portion of the population living in poverty despite overall economic progress.

| Country | Major Economic Challenges |

|---|---|

| Venezuela | Hyperinflation, political instability, reliance on oil |

| Argentina | High inflation, public debt, political instability |

| Nicaragua | Authoritarianism, decreased investor confidence, political instability |

| Haiti | Persistent poverty, natural disasters, weak governance |

| Bolivia | Dependence on commodity prices, economic inequality |

Which South American country has a bad economy?

Defining "bad" economy is subjective and depends on the metrics used. However, several South American countries have faced significant economic challenges in recent years. Venezuela consistently ranks among those with the most severely struggling economies, experiencing hyperinflation, widespread poverty, and a severe contraction in GDP.

Venezuela's Hyperinflation Crisis

Venezuela's economy has been devastated by hyperinflation, political instability, and a dependence on oil. This has led to widespread shortages of essential goods, a collapse in the value of the bolivar, and a humanitarian crisis. The country has struggled to attract foreign investment and implement necessary economic reforms.

- Hyperinflation: The rate of inflation has reached astronomical levels, rendering the national currency virtually worthless.

- Shortages: Basic necessities like food and medicine are frequently unavailable.

- Political instability: Political turmoil and corruption have hindered economic recovery efforts.

High Levels of Poverty and Inequality in multiple countries

Many South American countries grapple with high levels of poverty and inequality, impacting economic growth and stability. This disparity limits opportunities for a significant portion of the population and hampers overall development. Addressing this requires comprehensive social programs and policies aimed at wealth redistribution and equal opportunities.

- Income inequality: A significant gap exists between the rich and poor, hindering social mobility.

- Poverty rates: High poverty rates limit consumer spending and economic activity.

- Lack of access to resources: Many citizens lack access to education, healthcare, and basic infrastructure.

Argentina's Economic Volatility

Argentina has a history of economic instability, marked by periods of high inflation, currency devaluation, and sovereign debt defaults. The country's economy is heavily reliant on agricultural exports and vulnerable to global commodity price fluctuations. Structural reforms are often hampered by political gridlock and social resistance.

- Recurring crises: Argentina has experienced numerous economic crises throughout its history.

- High inflation: Inflation remains a persistent challenge for the Argentine economy.

- Debt defaults: Argentina has defaulted on its sovereign debt multiple times.

Dependence on Commodity Exports

Many South American economies are heavily dependent on the export of raw materials, making them vulnerable to fluctuations in global commodity prices. When prices fall, these countries experience significant economic downturns, impacting their ability to invest in infrastructure, education, and other crucial areas.

- Price volatility: Commodity prices are highly volatile, impacting export revenue.

- Lack of diversification: Over-reliance on a few commodities leaves economies susceptible to shocks.

- Limited value addition: Many countries export raw materials without processing them domestically, limiting economic benefits.

Impact of External Factors

South American economies are significantly impacted by global economic trends, including interest rate changes in developed countries, fluctuations in the value of the US dollar, and global demand for commodities. These external factors can exacerbate existing economic challenges and create new ones.

- Global financial crises: South American economies are often vulnerable to global economic downturns.

- US dollar fluctuations: Changes in the value of the US dollar can impact trade and investment.

- Interest rate hikes: Increased interest rates in developed countries can lead to capital flight from South America.

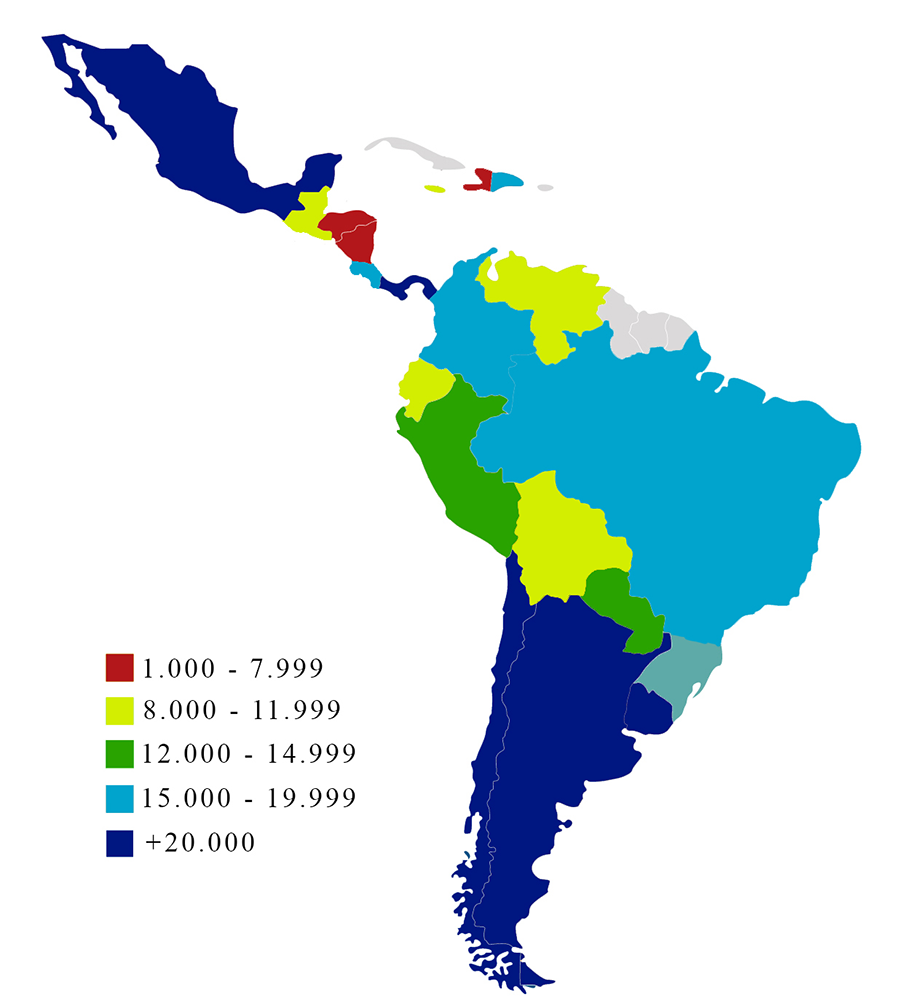

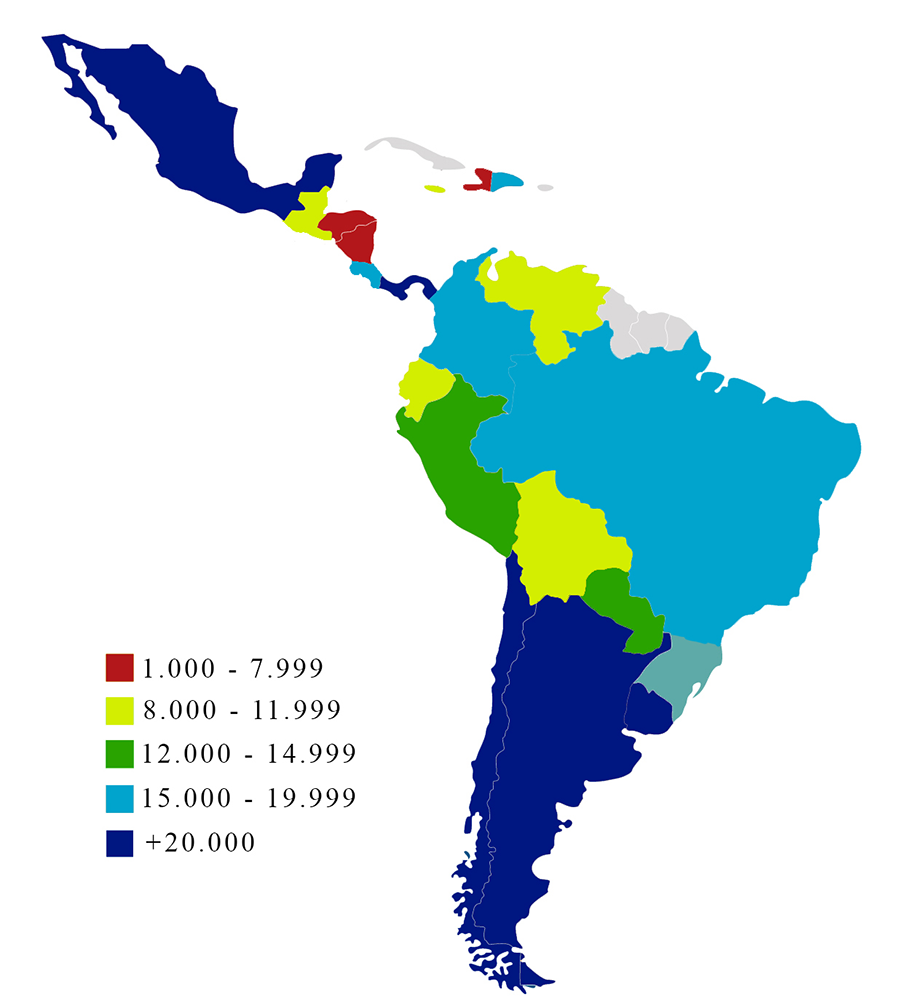

What is the least economically developed country in South America?

Determining the single "least" economically developed country in South America is challenging due to the complexities of economic measurement and the nuances of development indicators. Different indices and methodologies yield varying results. However, based on a combination of factors like GDP per capita, Human Development Index (HDI), poverty rates, and infrastructure, Bolivia consistently ranks among the least developed nations in the region.

Factors Contributing to Bolivia's Low Economic Development

Bolivia's low economic development is a multifaceted issue stemming from a complex interplay of historical, geographical, and political factors. Historically, Bolivia has struggled with political instability and periods of authoritarian rule, hindering consistent economic growth and investment. Geographically, much of the country is landlocked and mountainous, making transportation and trade challenging. This geographical limitation further isolates many communities, limiting access to essential services and hindering economic integration.

- Political Instability: Frequent changes in government and policies have hampered long-term planning and investment.

- Uneven Resource Distribution: While Bolivia possesses significant natural resources, these are often unequally distributed, benefiting a select few rather than driving broad-based development.

- Infrastructure Deficiencies: Inadequate infrastructure, particularly in transportation and communication, limits access to markets and economic opportunities.

Poverty and Inequality in Bolivia

High poverty rates and significant income inequality are defining characteristics of Bolivia's economic landscape. A substantial portion of the population lives below the poverty line, lacking access to basic necessities such as food, healthcare, and education. This inequality is further exacerbated by disparities in access to resources and opportunities based on ethnicity and geographic location. Addressing this deep-seated inequality is critical for fostering sustainable economic development.

- High Poverty Rates: A significant percentage of the Bolivian population struggles to meet their basic needs.

- Income Disparities: The gap between the rich and poor remains substantial, hindering social mobility.

- Access to Basic Services: Unequal access to healthcare, education, and sanitation contributes to the persistence of poverty.

Human Development Indicators in Bolivia

Bolivia's performance on key Human Development Indicators (HDI) remains relatively low compared to other South American nations. Factors such as life expectancy, literacy rates, and educational attainment lag behind regional averages. Improvements in these indicators are essential for ensuring a more prosperous and equitable society. Investing in human capital is crucial for long-term economic growth.

- Lower Life Expectancy: Compared to other South American countries, life expectancy in Bolivia is relatively low.

- Lower Literacy Rates: A significant portion of the population lacks basic literacy skills, limiting economic opportunities.

- Limited Educational Attainment: Access to quality education remains limited, particularly in rural areas.

Economic Dependence on Raw Materials

Bolivia's economy is significantly reliant on the extraction and export of raw materials, particularly minerals like lithium and natural gas. This dependence on commodities makes the country vulnerable to fluctuations in global prices and limits its ability to diversify its economy. Reducing this dependence and fostering industrialization and value-added production are crucial for sustained growth.

- Price Volatility: Fluctuations in global commodity prices directly impact Bolivia's economic stability.

- Limited Diversification: The economy's heavy reliance on raw materials hinders diversification and resilience.

- Lack of Value-Added Processing: Bolivia often exports raw materials rather than processed goods, missing opportunities for greater economic returns.

Government Initiatives and Challenges

The Bolivian government has implemented various initiatives aimed at alleviating poverty and stimulating economic growth. These include social programs focused on poverty reduction and investments in infrastructure. However, challenges remain in effectively implementing these programs, improving governance, and attracting foreign investment to stimulate private sector growth. Sustainable and inclusive development requires strong institutions and effective policies.

- Social Programs: Government initiatives aimed at reducing poverty and inequality.

- Infrastructure Development: Investments in infrastructure to improve connectivity and access to services.

- Foreign Investment Attraction: Efforts to attract foreign investment to boost economic activity.

What are the top 3 economies in South America?

Determining the "top" economies requires a specific metric. Using nominal Gross Domestic Product (GDP) as the measure, the three largest economies in South America are typically Brazil, Argentina, and Colombia. However, rankings can shift slightly depending on the year and the data source used. It's important to note that GDP per capita (GDP divided by population) provides a different perspective, showing the average wealth per person, which often differs significantly from overall GDP size.

Brazil's Economic Powerhouse

Brazil boasts the largest economy in South America, significantly outpacing its neighbors in terms of overall GDP. Its economy is diverse, encompassing agriculture (particularly soybeans and coffee), mining (iron ore), manufacturing (automobiles and aircraft), and a growing service sector. However, Brazil faces challenges including income inequality, inflation, and bureaucratic hurdles that impede faster growth.

- Strong agricultural sector: A major exporter of agricultural commodities, contributing significantly to GDP.

- Large and diverse industrial base: Manufacturing plays a crucial role, with significant contributions from various sectors.

- Significant natural resources: Abundant reserves of minerals and other resources contribute to economic activity.

Argentina's Economic Volatility

Argentina consistently ranks among the top three South American economies, but it's known for its economic volatility. Historically, Argentina has experienced periods of significant growth followed by deep recessions and high inflation. The country's economy relies heavily on agriculture (soybeans, wheat), and it has a substantial industrial sector, although it faces challenges related to macroeconomic instability and external debt.

- Fluctuations in agricultural exports: Economic performance is often tied to global commodity prices.

- High inflation rates: This has been a recurring problem, eroding purchasing power and impacting investment.

- Significant levels of public debt: This poses a constant threat to macroeconomic stability.

Colombia's Growing Economy

Colombia has steadily grown its economy in recent years, consolidating its position as one of the largest in South America. Its economy is diversified, with strengths in coffee production, mining (coal, gold), and a growing manufacturing and service sector. However, Colombia continues to grapple with issues such as inequality and security challenges that can impact its long-term growth prospects.

- Significant coffee production: A major exporter of coffee beans, contributing substantially to foreign exchange earnings.

- Growth in the service sector: A growing and increasingly important component of the Colombian economy.

- Mining sector: A source of significant revenue and employment, although subject to global price fluctuations.

Challenges Facing South American Economies

Many South American economies face common challenges that impede their growth potential. These include high levels of income inequality, dependence on commodity exports (making them vulnerable to global price swings), infrastructure deficiencies, and political and social instability. Addressing these issues is crucial for achieving sustainable and inclusive economic development.

- Commodity price volatility: Many economies heavily rely on commodity exports, making them susceptible to global price fluctuations.

- Infrastructure gaps: Insufficient infrastructure hinders economic growth and competitiveness.

- Income inequality: A persistent problem that limits inclusive growth and social stability.

Regional Economic Integration

Efforts toward regional economic integration, such as through trade agreements (like MERCOSUR), aim to promote greater economic cooperation and reduce trade barriers among South American countries. While these efforts have had some success, challenges remain in achieving seamless integration due to differing national priorities and economic structures.

- MERCOSUR: A significant regional trade bloc aiming to foster economic cooperation.

- Bilateral trade agreements: Several South American countries have signed bilateral trade agreements to enhance trade relationships.

- Obstacles to integration: Differences in economic policies and political agendas can hinder seamless integration.

Which South American country has bad inflation?

Several South American countries have experienced periods of high inflation, and the situation can change rapidly. There's no single country consistently experiencing "bad" inflation as the definition of "bad" is subjective and depends on the threshold used. However, Venezuela has consistently suffered from hyperinflation for many years, making it a prime example of a country with extremely high and damaging inflation. Other countries have experienced significant inflationary pressures at various times, and their situation should be assessed based on current data from reliable sources like the IMF or World Bank.

Causes of High Inflation in South America

High inflation in South America is often a complex issue stemming from various interconnected factors. Monetary policy plays a crucial role, with excessive money printing often leading to inflation. Fiscal deficits, where government spending exceeds revenue, can also contribute significantly, forcing governments to borrow heavily and increase the money supply. External shocks, such as fluctuations in global commodity prices or currency devaluations, can amplify inflationary pressures. Finally, supply chain disruptions and political instability can exacerbate already existing challenges.

- Excessive Money Printing: Governments printing more money than the economy can absorb leads to a devaluation of currency and rising prices.

- Government Spending: Large budget deficits requiring increased borrowing can fuel inflation.

- Global Commodity Prices: Dependence on commodity exports makes South American economies vulnerable to price fluctuations.

Venezuela's Hyperinflation Crisis

Venezuela stands out as a stark example of hyperinflation. Years of mismanagement, political instability, and declining oil production have severely damaged the economy. The government's reliance on printing money to finance its spending has driven the bolivar's value to almost nothing, causing prices to soar uncontrollably. The consequences have been devastating for the population, leading to widespread poverty and hardship.

- Mismanagement and Corruption: Decades of ineffective economic policies and corruption have contributed to the crisis.

- Oil Dependence: Venezuela's heavy reliance on oil exports makes it vulnerable to global oil price changes.

- Political Instability: Political upheaval and sanctions have further destabilized the economy.

Argentina's Recurring Inflation Problem

Argentina has a long history of struggling with inflation, experiencing recurring periods of high inflation. While not always at hyperinflationary levels like Venezuela, Argentina's inflation rates are often far above those of developed countries. This is usually attributed to a combination of factors, including fiscal imbalances, currency devaluation, and sometimes, wage-price spirals.

- Fiscal Imbalances: Consistent government budget deficits have put pressure on the Argentinian peso.

- Currency Devaluation: Frequent devaluations of the peso contribute to higher prices.

- Wage-Price Spirals: Workers demanding higher wages to keep up with rising prices can lead to an inflationary feedback loop.

The Role of the International Monetary Fund (IMF)

The IMF often plays a crucial role in assisting South American countries facing severe inflation. It provides loans and technical assistance to help countries implement economic reforms aimed at stabilizing their economies and reducing inflation. These reforms often involve measures like fiscal consolidation, monetary policy adjustments, and structural reforms to boost economic productivity.

- Loan Programs: The IMF provides financial assistance to countries facing economic crises.

- Technical Assistance: The IMF offers expertise to help countries develop sound economic policies.

- Conditionality: IMF loans often come with conditions requiring countries to implement specific reforms.

Measuring and Comparing Inflation Across Countries

Comparing inflation across countries requires careful consideration of methodologies. While inflation rates are usually expressed as a percentage change in a price index (like the Consumer Price Index or CPI), different countries may use slightly different methodologies for calculating their indices. Furthermore, differences in the composition of the basket of goods and services used in the index can also affect comparability. Data reliability is also an important factor to consider, especially in countries with weak statistical institutions.

- Consumer Price Index (CPI): A widely used measure of inflation that tracks the changes in prices of a basket of goods and services consumed by households.

- Methodology Differences: Variations in the methods used to calculate inflation rates can affect comparisons between countries.

- Data Quality: Accurate and reliable data are essential for meaningful inflation comparisons.

Which South American country currently has the worst economy?

Pinpointing the single "worst" economy in South America is tricky, as economic health is measured by various indicators, and rankings fluctuate frequently. No single metric perfectly captures a country's overall economic well-being. However, several countries consistently rank poorly across numerous economic measures. Venezuela frequently tops lists of the worst-performing economies in the region, grappling with hyperinflation, crippling shortages of essential goods, and a severely weakened currency. Its GDP per capita is drastically lower than other South American nations, and its overall economic output has contracted significantly over the past decade. While other nations like Nicaragua, Haiti (although geographically in the Caribbean, its economy is often compared to South American ones due to its close ties), and Suriname may also experience significant economic challenges, including high poverty rates and volatile growth, the depth and duration of Venezuela’s economic crisis often set it apart.

It is important to remember that these rankings are dynamic. Political instability, natural disasters, and global economic trends can drastically alter a country's economic performance within a short period. Therefore, any declaration of the "worst" economy should be considered a snapshot in time, subject to change.

How is the "worst" economy determined in South America?

There's no single, universally accepted method to determine the "worst" economy. Economists and international organizations utilize a range of economic indicators to assess a country's financial health. These include, but aren't limited to, GDP growth rate (the rate at which a country's economy is expanding or contracting), GDP per capita (GDP divided by the population, reflecting the average income), inflation rate (the rate at which prices for goods and services are rising), unemployment rate (the percentage of the labor force that is unemployed), poverty rate (the percentage of the population living below the poverty line), and public debt (the amount of money a government owes). Each of these indicators provides a different perspective on a country's economic situation.

Furthermore, the weight given to each indicator varies depending on the specific assessment and the goals of the analyst or organization. For instance, some analyses might prioritize GDP growth, while others might focus on poverty reduction or inflation control. This lack of a single, universally agreed-upon metric makes definitive rankings complex and potentially subjective.

What are the main factors contributing to poor economies in South America?

Several intertwined factors contribute to poor economic performance in South America. Political instability, including corruption and weak governance, often hampers economic development by discouraging investment and creating uncertainty. Inequality, with significant disparities in wealth distribution, can limit economic mobility and create social unrest. Dependence on commodity exports makes many South American economies vulnerable to fluctuations in global commodity prices, leading to economic volatility. Lack of infrastructure investment in areas such as transportation, energy, and communication hinders economic growth and competitiveness.

Additionally, high levels of debt can constrain government spending and economic policies. Weak institutions, including inefficient legal systems and a lack of transparency, can discourage foreign investment and hinder economic development. Natural disasters can also severely impact economic activity, particularly in vulnerable economies.

What are the potential solutions to improve struggling South American economies?

Addressing the challenges faced by struggling South American economies requires a multi-faceted approach. Strengthening governance and tackling corruption are crucial for creating a stable and predictable investment climate. Implementing economic diversification strategies, reducing reliance on commodity exports, and promoting value-added industries can create more resilient economies. Investing in human capital through education and skills development can improve productivity and competitiveness. Promoting inclusive growth, addressing inequality, and reducing poverty are essential for social stability and long-term economic development.

Furthermore, improving infrastructure, fostering innovation, and attracting foreign investment can boost economic growth. Implementing sound fiscal and monetary policies, effectively managing public debt, and controlling inflation are also critical for long-term economic stability. Finally, regional cooperation and integration can unlock new economic opportunities and facilitate shared prosperity.

Deja una respuesta